Core Enablement Video

Got Red Hat?

A Theoretical Application of our Business Models

The foundational physics of how Red Hat software is sold. Three delivery models, one milk analogy — everything builds on this.

Sell — Commercial

Sell — Commercial

Open Attach — Platforms & Devices

Open Attach — Platforms & Devices

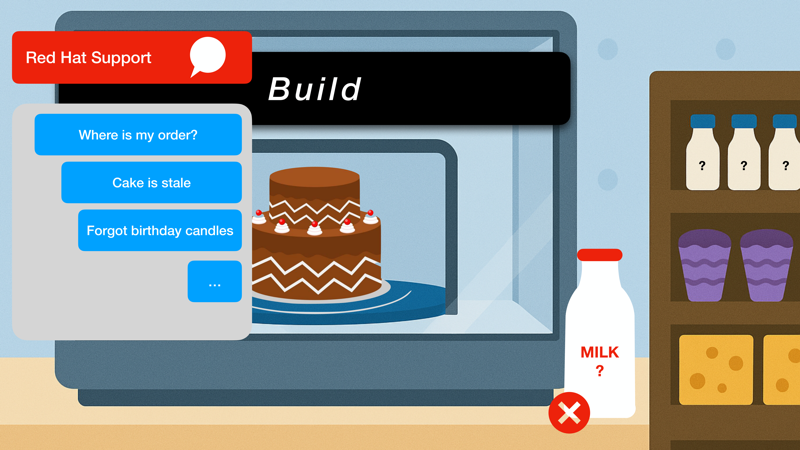

Closed Attach — Services / Build

Closed Attach — Services / Build